Acquisition project | Ditto Insurance

Are you 1 of the 37 million Indians struggling to navigate health or life insurance?

Ditto Insurance makes buying insurance simple and stress-free. We guide you in making informed decisions—from selecting and buying to claiming policies with complete transparency. Trusted by over 300,000 happy customers and backed by an 4.9 out of 5 rating from more than 10,000 Google reviews, Ditto is redefining how Indians approach insurance[1]. Unlike traditional agencies that overwhelm you with jargon, spam calls, and pushy sales tactics, Ditto provides trusted, no-pressure guidance tailored to your needs. Whether you’re a young professional looking for personal health coverage or a family-oriented individual securing protection for loved ones, Ditto ensures clarity and confidence in every step of the journey.

Join the customer-first revolution to buy insurance at jionditto.in—your peace of mind is just a call away

Dissecting the Pitch:

Element | Content | Why It Works |

|---|---|---|

Hook | “Are you 1 of the 37 million Indians struggling to navigate health or life insurance?” | Grabs attention by addressing a widespread pain point directly. The rhetorical question creates relatability and prompts the user to reflect on their situation. |

Value | “Ditto Insurance makes buying insurance simple and stress-free. We provide trusted, no-pressure guidance tailored to your needs, with transparency at every step.” | Clearly communicates Ditto’s unique value resonating with users who are frustrated with traditional insurance agencies. |

Evidence | “Trusted by over 300,000 happy customers and backed by a 4.9 out of 5 rating from more than 10,000 Google reviews, Ditto is redefining how Indians approach insurance” | Builds credibility through quantitative proof. Highlights Ditto’s reach and positive reputation, making it a trustworthy option for users. |

Differentiator | “Unlike traditional agencies that overwhelm you with jargon, spam calls, and pushy sales tactics, Ditto provides clear, tailored advice without pressure.” | Highlights the contrast with competitors by addressing common complaints (spam calls, pushy sales) while offering a refreshing alternative—personalised, jargon-free help. |

Who is it for? | "Young professionals seeking personal health coverage and family-oriented individuals securing protection for their loved ones." | Speaks directly to Ditto’s priority ICPs, ensuring relevance by aligning the pitch with their specific goals and needs. |

Call to Action | “Join the customer-first revolution to buy insurance at joinditto.in—your peace of mind is just a call away.” | Ends with an empowering CTA that creates a sense of movement (revolution) and urgency while ensuring an easy next step for the user. |

Why did I choose Ditto Insurance?

- In 2020, a close friend of mine, lost his father to COVID-19. Without health insurance, his family had to bear the medical expenses entirely out of pocket, causing significant financial strain. This incident opened my eyes to a broader issue: approximately 63% of Indians finance healthcare costs from their own pockets. With healthcare costs rising up by 14% annually, it is leading to families going bankrupt [2]

- The way insurance agents are often perceived in pop culture adds to the problem. A popular Telugu movie called Oye humorously shows an insurance agent training by enduring customer complaints and frustrations. While exaggerated, it reflects the negative perception people have of insurance agents, making the industry a tough yet interesting space to disrupt.

- There’s a growing awareness of personal finance among Millennials and Gen Z, driven by online content and financial education platforms. This new generation is more open to insurance but demands better experience.

- Personally, I’ve always been passionate about the healthcare sector and have worked with several founders solving niche problems in this space. From my experience, disrupting the health and life insurance market is essential for India to achieve better health outcomes and financial security in the future.

All these factors—my personal interest in Healthcare, the growing need for financial security, the challenges and perceptions surrounding the insurance industry, and the increasing awareness among Millennials and GenZ—led me to choose Ditto Insurance for this project.

Methodology:

To understand Ditto Insurance’s users better, I’m conducting user research by speaking with different groups of people:

- Ditto Customers (4) – People who have used Ditto to purchase insurance.

- Non-Renewing or Unconverted Customers (2) – Those who either didn’t proceed with Ditto after the first call or chose not to renew their insurance.

- Customers of Other Insurance Providers (3) – Individuals who have purchased insurance from companies other than Ditto.

- Uninsured Individuals (1) – People who don’t currently hold any form of insurance.

Note: I am focusing on older Gen Z and younger Millennials aged 24–35 wherein the internet-based product adoption is high. As Ditto is an internet-first platform, this demographic is most likely to interact with its services and provide relevant insights.

Although the data might be skewed due as the sample size is not statistically insignificant, this information can form basis to test the channels that could work for Ditto Insurance

Discussion Guide:

- Who is the Interviewee?

- Age

- Gender

- City of Residence

- Occupation

- Relationship Status

- General User Questions

- When you think of health or life insurance, what’s the first thing that comes to your mind? Why?

- How did you know that insurance important for you?

- Have you ever faced or heard of a situation where insurance played a significant role? If yes, how did it impact your perception of insurance?

- What look for you before buying a health insurance?

- Specific Questions

- Ditto Customers:

- What prompted you to choose Ditto for your insurance needs?

- How would you describe your experience with Ditto so far?

- Was there anything Ditto did particularly well or something you think they could improve?

- Did you refer Ditto to anyone else?

- Unconverted Customers:

- Where did you get your current insurance from?

- Did you interact with Ditto policy? What was your experience

- What made you decide not to proceed with Ditto after your initial interaction?

- Was there anything Ditto did particularly well or something you think they could improve?

- Customers of Other Insurance Providers:

- How did you choose your current insurance provider, and what stood out to you about them?

- What’s been your experience with your current provider’s services, especially when buying or claiming insurance?

- If you were to switch providers, what factors would influence your decision?

- Uninsured Individuals:

- Have you considered buying health or life insurance before? If not, what’s held you back?

- What do you think would make insurance more appealing or relevant for you?

- If you were to look for insurance, where would you start, and what would you look for?

Raw Data:

Sharing an excel sheet categorising and filling up all the answers received from the personal interviews.

Click here to access the sheet

Top 4 Trends from Customer Interviews:

There are four patterns that I've observed from the interviews

Insurance as a Financial Safety Net

A significant number of respondents’ understanding of insurance stemmed from either personal experiences or those of friends and family. For example:

• Respondents mentioned incidents where insurance helped cover hospitalisation costs for close acquaintances, making them realise its importance.

• For some, the absence of insurance during emergencies (e.g., a friend’s hospitalisation without coverage) was a wake-up call to explore it further.

• A few respondents credited their awareness to educational platforms like blogs, YouTube, and recommendations from family members, rather than formal financial education or marketing.

Key Trigger Points for Purchasing Insurance

Respondents revealed clear moments in their lives that acted as triggers for purchasing insurance. These include:

• Starting to earn: This is a common time for individuals to consider their financial future and begin planning for security.

• Life milestones: Events like marriage or planning for children often prompt people to think about the well-being of their dependents.

• Aging parents: Concern for aging parents’ health drives many to explore insurance options to avoid financial strain during medical emergencies.

• Policy expiration: Renewing or upgrading an expiring policy is another key driver, particularly when users re-evaluate their needs.

Awareness Influenced by Personal Experiences and Word of Mouth

A significant number of respondents’ understanding of insurance stemmed from either personal experiences or those of friends and family. For example:

• Respondents mentioned incidents where insurance helped cover hospitalisation costs for close acquaintances, making them realise its importance.

• For some, the absence of insurance during emergencies (e.g., a friend’s hospitalisation without coverage) was a wake-up call to explore it further.

• A few respondents credited their awareness to educational platforms like blogs, YouTube, and recommendations from family members, rather than formal financial education or marketing.

Key Decision-Making Factors: Trust, Transparency, and Simplicity

When choosing a health or life insurance policy, respondents consistently highlighted these factors:

• Trust: High claim settlement ratios and long-standing reputation in the industry were top priorities for many.

• Transparency: Hidden clauses, unclear exclusions, and complicated claim processes were major deterrents. Respondents valued insurance providers who were upfront about their policies.

• Simplicity: The ability to understand policy details without excessive jargon or rules was critical, especially for first-time buyers. For example, some respondents used blogs and YouTube to compare providers based on these criteria.

Understanding your ICP

Criteria | User 1 (Young Professional) | User 2 (Family-Oriented Individual) |

|---|---|---|

Name | Arjun | Neha |

Age | 25 | 34 |

Demographics | Male, Single, Early-stage career, Urban (Bangalore), lives alone/with friends | Female, Married, Mid-career, Urban (Mumbai) |

Salary Range | ₹4–10 LPA | ₹18–30 LPA |

Financial Literacy | Moderate: Understands basics but needs guidance for complex decisions | High: Regularly budgets and plans for financial security |

Dependents (Yes/No) | No | Yes (Spouse, children, aging parents) |

Social Media Presence | Active on Instagram, LinkedIn & Snapchat | Active on Facebook, LinkedIn and WhatsApp Groups |

App They Spend Time On | YouTube, Zomato, Reddit, GPay, Cult.Fit | Parenting apps, financial planning apps, Amazon, Pinterest, HealthifyMe |

Likely Personal Influence | Financial blogs, peers, parents and YouTube influencers | Family, spouse, colleagues and trusted friends |

Content Consumption Patterns | Watches YouTube videos on personal finance and tech reviews, listens to podcasts on productivity | Watches parenting content on YouTube, reads blogs on family health and insurance |

Need | Wants personal health insurance independent of employer benefits | Wants comprehensive family coverage for health and life insurance |

Pain Point | Limited awareness of policies & struggles to compare plans easily | Concerns about dependents’ future & High costs of family healthcare |

Solution |

|

|

Behaviour |

|

|

Perceived Value of Ditto | A trusted advisor that helps navigate complex insurance terms and make informed decisions | A reliable partner offering safety and security for her family |

Marketing Pitch | Get affordable health insurance tailored to your needs. No jargon, just clarity and peace of mind. | Secure your family’s future with comprehensive, hassle-free insurance agent |

Goals | Financial independence & Preparedness for emergencies | Protection for family & Long-term financial security |

Frequency of use case | Once every few years (renewals or policy upgrades) | Once every few years, often around major life events (e.g., marriage, children, policy renewal) |

Average Spend on the product | ₹8,000–₹12,000 annually | ₹20,000–₹30,000 annually |

Value Accessibility to product | Easy to access online tools and comparison features | Direct access to knowledgeable agents and family-friendly plans |

Value Experience of the product | Seamless onboarding, straightforward claims process | Transparent coverage details and responsive customer support |

ICP prioritisation table:

Criteria | ICP 1 (Young Professionals) | ICP 2 (Family-Oriented Individuals) |

|---|---|---|

Adoption Curve | High | Moderate |

Appetite to Pay | Moderate | High |

Frequency of Use Case | Low | High |

Distribution Potential | High | High |

TAM | Approx. 80 million young professionals in India, primarily urban-based, entering workforce annually. Includes IT/Tech, Finance, and other growth sectors. | Approx. 50 million mid-career professionals (age 30–40) with families. Includes dual-income households in Tier 1 and Tier 2 cities with increasing disposable income. |

Analysis

- ICP 1: Young Professional

• Strengths: High adoption rate and distribution potential due to their tech-savvy nature and presence on social platforms like LinkedIn, Instagram, and YouTube. They actively seek solutions for financial independence and future preparedness.

• Challenges: Frequency of use case is low as this segment primarily invests in insurance as a one-time setup or early-career milestone. They also need significant education on why insurance matters.

• TAM Insight: This segment has a larger TAM due to the high number of professionals entering the workforce annually. With targeted educational campaigns, they can become long-term customers.

- ICP 2: Family-Oriented Individual

• Strengths: High appetite to pay and frequency of use case due to their focus on protecting family and dependents. They seek comprehensive solutions (health + life insurance) and prioritise trust and transparency in brands.

• Challenges: Adoption rate is moderate as they tend to rely on recommendations from family, friends, or agents. Acquisition requires strong relationship-building strategies.

• TAM Insight: Smaller but more lucrative market due to higher disposable income and willingness to invest in policies with significant coverage.

Conclusion:

Based on the analysis, ICP 2 (Family-Oriented Individual) emerges as the primary target segment due to their high appetite to pay, frequent use cases, and focus on securing their family’s future, making them a more lucrative market with strong monetisation potential. Tailored strategies emphasising trust, transparency, and comprehensive solutions can drive adoption in this segment. Meanwhile, ICP 1 (Young Professional), with a significantly larger TAM and high adoption rate, serves as an excellent secondary segment for long-term growth. Educational content, affordable plans, and leveraging their tech-savvy behaviour can help establish Ditto as their go-to insurance provider early in their financial journey.

Exploring the Product

The product is rather simple to use. Customers interact with Ditto through its website and advisory calls.

Process of buying Insurance from Ditto:

Here is a conversation with Ditto Insurance:

This interaction demonstrates Ditto Insurance’s commitment to simplifying insurance processes through personalised and transparent communication. Their WhatsApp-based advisory is well-suited for tech-savvy customers, emphasising clarity and accessibility. However, opportunities exist to further streamline decision-making by offering stronger, prioritised recommendations or scheduling follow-ups to expedite resolutions.

This interaction demonstrates Ditto Insurance’s commitment to simplifying insurance processes through personalised and transparent communication. Their WhatsApp-based advisory is well-suited for tech-savvy customers, emphasising clarity and accessibility. However, opportunities exist to further streamline decision-making by offering stronger, prioritised recommendations or scheduling follow-ups to expedite resolutions.

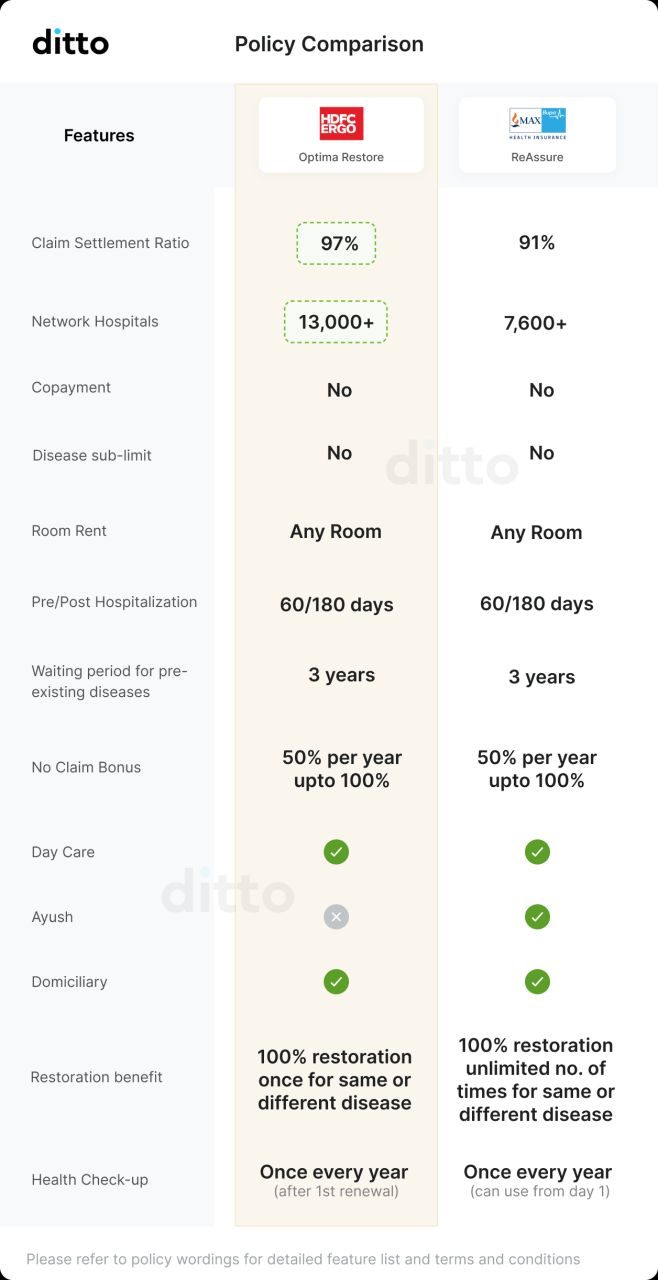

Sample comparison report:

Top Features of the Ditto:

- Extensive knowledge repository on navigating insurance

- Jargon-free policy explanations

- Personalised free advisory calls

- Transparent pricing comparisons

- Support during claims processes

- No spam calls

Strong PMF:

Ditto Insurance has successfully achieved strong Product-Market Fit (PMF) by addressing a significant gap in the insurance landscape. This is evident from the overwhelming positive feedback from customers across platforms, who emphasise Ditto’s customer-first approach, transparent communication, and seamless claim support. With testimonials highlighting the no-spam policy, easy-to-understand recommendations, and emotional connection during critical moments, Ditto has solidified its position as a trusted partner in insurance. Its ability to deliver consistent value to diverse audiences, from young professionals to families, underscores its alignment with market needs and customer expectations.

Ditto Insurance has successfully achieved strong Product-Market Fit (PMF) by addressing a significant gap in the insurance landscape. This is evident from the overwhelming positive feedback from customers across platforms, who emphasise Ditto’s customer-first approach, transparent communication, and seamless claim support. With testimonials highlighting the no-spam policy, easy-to-understand recommendations, and emotional connection during critical moments, Ditto has solidified its position as a trusted partner in insurance. Its ability to deliver consistent value to diverse audiences, from young professionals to families, underscores its alignment with market needs and customer expectations.

Core Value Proposition of Ditto

For individuals and families who need clear, reliable, and hassle-free insurance solution, our personalised advisory-first platform simplifies complex decisions, ensures transparency, and provides dedicated support during claims.

Market Landscape:

Here is a quick illustration on the market landscape of Insurance industry in India:

Basic Competitor Analysis:

Factors | PolicyBazaar | InsuranceDekho |

|---|---|---|

What is the core problem being solved by them? | Simplifying insurance comparison and ease of use. | Simplifies insurance buying with a platform for comparing and purchasing policies. |

What are the products/features/services being offered? | Aggregator platform for health, life, motor, and term insurance. | Health, life, car, and bike insurance comparisons, plus tools for agents. |

Who are the users? | Retail customers seeking direct policy comparisons and purchases. | Retail customers and insurance agents in Tier 2/3 cities. |

GTM Strategy | Heavy investment in digital advertising, partnerships with insurers, and content marketing (blogs, videos). | Combines digital marketing and a vast network of agents for market penetration. |

What channels do they use? | Google, YouTube, LinkedIn, TV ads, blogs, and direct partnerships with insurers. | Online platform, agent networks, and localised digital campaigns. |

What pricing model do they operate on? | Commission-based revenue model, earning on policies sold via the platform. | Commission-based earnings from insurers for policies sold. |

How have they raised funding? | Multiple rounds of funding from top VCs; went public in 2021 (Policybazaar IPO). | Raised $150M in Series A funding (2023), led by Goldman Sachs and TVS Capital. |

Brand Positioning | The leading insurance comparison platform | A digital platform making insurance accessible and empowering agents. |

UX Evaluation | Easy-to-use, highly functional platform with policy filters and comparisons, but sometimes overwhelming due to excessive options. | User-friendly platform with smooth navigation for policy comparison and purchase. |

What can you learn from them? | Customers like variety & have side-by-side comparison of multiple policies | The value of tech-enabled agent networks and localised marketing strategies. |

Feature Comparison:

Feature | Ditto Insurance | Policybazaar | InsuranceDekho |

|---|---|---|---|

Personalised One-on-One Consultations | ✅ Yes | ❌ No | ❌ Limited |

Spam-Free Experience | ✅ Yes | ❌ No | ❌ No |

Policy Comparison Tools | ✅ High-Quality Comparisons | ✅ Extensive Comparisons | ✅ Basic Comparisons |

Clear Explanation of Terms | ✅ Detailed and Transparent | ❌ Limited Details | ❌ Limited Details |

Dedicated Claim Support Team | ✅ Comprehensive Support | ❌ Minimal Post-Sale Assistance | ❌ Basic Claim Support |

Educational Resources | ✅ Blogs, Videos, and Checklists | ✅ Basic Articles | ❌ Limited |

Customer Reviews/Testimonials | Very high-rating | Mixed Reviews; negatively skewed | Mixed Reviews; positively skewed |

Transparency in Pricing | ✅ No Hidden Fees | ❌ Heavily Partner-Driven Recommendations | ❌ Heavily Partner-Driven Recommendations |

Renewal Reminders | ✅ Yes - through insurer | ✅ Provided | ✅ Provided |

Ease of Submitting Claims | ✅ Simple, Guided Process | ❌ Left to Insurers | ❌ Limited Support |

Proactive Guidance on Claims | ✅ Yes | ❌ Limited | ❌ No |

Clean and Intuitive UI & UX | ✅ Minimal and User-Centric | ❌ Cluttered | ✅ Good |

Key Insights from the Comparison:

- Ditto Insurance dominates in personalisation with personalised consultations, transparency, and spam-free service, Ditto offers a unique user-first approach.

- Policybazaar excels in comparisons but lacks transparency. While it provides extensive comparison tools, it fails in delivering clear terms or personalized services.

- InsuranceDekho falls behind in customer experience. Though it offers basic claim support and comparisons, it lacks the depth of educational content or transparency required by today’s ICPs.

Market Trends for Insurance:

- Under-penetration of Insurance in India:

Despite being one of the fastest-growing insurance markets globally, India’s insurance penetration remains low at ~4.2% of GDP (IRDAI 2023). Health and life insurance are gaining traction, but adoption is still limited due to complexity and lack of awareness.

- Digital Transformation:

The rise of internet usage (~759 million users) and smartphone penetration (~50% of the population) is driving a shift toward online platforms for financial services, including insurance reshaping customer expectations.

- Increased Awareness Post-COVID-19:

The pandemic acted as a major trigger for health and life insurance adoption. Families realised the importance of financial safety nets, driving a surge in first-time insurance buyers.

- Regulatory Push:

IRDAI reforms, such as simplified processes and guidelines encouraging digital distribution, are fostering innovation in the sector.

- Younger Workforce:

Millennials and Gen Z, comprising ~60% of the workforce, are actively investing in financial security, including health and life insurance.

Market Sizing:

- Total Addressable Market (TAM)

- Who: Active adult internet users in India who could potentially purchase insurance.

- Size: ~410 million active adult internet users.

- Reference: Statista reports (2024) and IAMAI-Kantar report indicate ~759 million internet users in India, ~54% of which are adults actively using digital platforms for transactions and financial research.

- Assumption: Includes individuals across all demographics, irrespective of their current financial literacy or interest in insurance.

- Serviceable Addressable Market (SAM):

- Who: Adults in urban areas actively searching for insurance or considering financial security products like health and life insurance.

- Size: ~139 million users.

- Reference: Based on NITI Aayog and IRDAI reports, ~28% of urban adults using internet are either purchasing or actively considering insurance.

- Assumption: Focused on tech-enabled, financially aware adults in Tier 1 and Tier 2 cities.

- Serviceable Obtainable Market (SOM):

- Who: The subset of SAM specifically aligned with Ditto’s offering—urban Gen Z and millennials seeking personalised, jargon-free insurance advisory.

- Size: ~13.9 million users

- Reference: Reports by Google India and McKinsey Digital India suggest ~10% of GenZ & Millennials group actively engages with digital platforms for financial services like insurance.

- Assumption: Ditto Market Focus is Urban, tech-savvy users (ages 24–35) likely to value personalised advisory.

Designing Acquisition Channel

Ditto is in Early-Scaling Stage

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | Medium | High | Slow | High |

Paid Ads | High | High | Low | Fast | High |

Referral Program | Low | Low | Medium | Slow | Medium |

Product Integration | Moderate | Low | Medium | Medium | High |

Content Loops | Low | Low | Low | Fast | High |

Based on the prioritisation of acquisition channel, I'd like to focus on the following channels:

- Paid Ads are essential for driving immediate visibility and capturing high-intent users actively searching for insurance solutions, providing quick wins and measurable ROI.

- Content Loops leverage customer advocacy by incentivising social sharing, reviews, or referrals, creating a self-sustaining growth engine that scales with user engagement and builds brand virality.

- Organic Channels like SEO blogs and YouTube videos align with Ditto’s educational-first approach, building long-term trust and driving sustained traffic at minimal cost.

Organic Channel

Ditto benefits from a strong organic reach, significantly bolstered by its distribution channel through Finshots, which provides a steady stream of engaged and informed users. However, despite this advantage, Ditto struggles to appear on the first page of Google search results for the most critical keywords that its ICP actively searches for. This gap in visibility highlights an untapped potential to capture a larger share of organic traffic by optimising for high-intent search terms. Addressing this issue can enable Ditto to align its strong advisory proposition with the moments when its target audience is actively seeking insurance solutions, thereby converting search interest into actionable leads more effectively.

How do users get to know about Ditto?

Channel | How Users Learn About Ditto | Why It’s Effective |

|---|---|---|

FinShots | This is the biggest source of acquisition of Ditto. Through newsletters simplifying financial concepts, including insurance - allows users to solve for their pain point of understanding the complex topic. | Trusted financial education platform with a loyal, engaged reader base. Converts readers into customers with actionable insights. |

Colleagues | Users speak about insurance at office on the best plans. Word-of-mouth referrals in professional settings during casual conversations or financial discussions. | Trust is built within professional circles. Recommendations from colleagues hold significant credibility. |

Friends & Family | Recommendations shared in personal conversations or close WhatsApp groups for family planning or policy suggestions. Many users discuss policy with parents or their partners as they are the influencers in the process | Emotional trust and reliance on family recommendations make this channel highly effective for family-oriented users. |

Since the conversations of insurance is common in professional circles, it trickles down to LinkedIn. Users discover Ditto through testimonials or posts by satisfied customers and connections. | Builds credibility via authentic testimonials and professional endorsements. Ideal for the ICPs. | |

Instagram Ads | Users scroll through Instagram and learn about insurance through reels. Hence, visually appealing ads feature relatable family or financial planning scenarios to grab attention. | Captures scrolling attention of young professionals and family-oriented users. |

Google Search | The first thing an intended insurance buyer would do is google search. Users search for terms like “best insurance advisors” or “spam-free insurance guidance” to find Ditto organically. | Captures users with immediate intent and aligns with their problem-solving mindset. |

Summary of Channels:

- Strong Channels - FinShots, LinkedIn UGC, Colleagues, and Friends & Family due to their trust-building ability and targeted outreach.

- Emerging Channels - Instagram & LinkedIn Ads leverage social sharing and modern discovery behaviour.

- Opportunities for Growth: Optimising Google Search and collaborating with financial blogs can expand reach to digitally active ICPs.

Keywords Identified

- Use-Case Based Keywords:

- Best health insurance for families in India

- Affordable health insurance plans for couples”

- Life insurance with tax benefits

- Health insurance for pre-existing conditions India

- Which health insurance covers maternity benefits?

- Product/Service Keywords:

- How does Ditto Insurance work?

- Ditto Insurance reviews

- Simplified health insurance advisory platform

- Is Ditto better than insurance brokers?

- Free insurance advice platform in India

Search Volumes

Observations:

- Health Insurance consistently dominates search interest, indicating strong demand year-round.

- Policy Bazaar maintains steady search interest, showcasing high brand recall and credibility.

- Ditto Insurance shows sporadic spikes in search interest but remains low overall, indicating early-stage brand awareness.

- InsuranceDekho has minimal search visibility, making it a less significant competitor compared to Policy Bazaar.

- Search interest for health insurance lacks significant seasonal trends, suggesting it’s an evergreen category.

Insights:

- Health Insurance is a priority category with broad and generic traffic, showing consistent user demand.

- Policy Bazaar’s dominance stems from its strong brand equity and trusted position as an aggregator.

- Ditto Insurance’s sporadic spikes indicate successful but isolated campaigns, needing sustained efforts for consistent awareness.

- InsuranceDekho struggles with brand awareness, making Ditto’s focus on differentiation a key opportunity.

- The evergreen nature of health insurance suggests potential for year-round engagement rather than seasonal bursts.

Implications for Ditto:

- Focus on capturing health insurance-related keywords to tap into high-demand generic traffic.

- Build consistent, sustained marketing campaigns to improve Ditto’s brand recall and search visibility.

- Leverage Ditto’s unique advisory-first, no-spam approach to differentiate from competitors like Policy Bazaar.

- Target awareness campaigns that educate users and emphasise Ditto’s trustworthiness, especially for niche needs.

- Maintain a year-round campaign strategy for health insurance to align with consistent user interest.

Traffic Engagement:

Ditto has shown strong traffic growth with 2.169M visits globally, marking an 87.7% increase from the previous month. The majority of users (66.58%) access the site via mobile, highlighting the need for mobile-first strategies. Engagement metrics are solid, with a 3:43 average visit duration, 3.71 pages per visit, and a bounce rate of 45.4%. Ranked #4,079 in India and #625 in the investing/insurance sector, Ditto has a strong foothold in its target market but can optimise further to climb the industry rankings. The upward trend in traffic is promising, driven by effective campaigns and increasing visibility.

Focus Areas:

- Optimise for mobile users.

- Improve bounce rates to boost conversions.

- Identify what’s driving the recent growth and scale those channels further.

- Keep building trust and visibility to climb industry rankings.

Distribution Plan:

Primary Platform

A. Google Search (SEO)

Method:

- Target high-volume, evergreen health insurance keywords like “best health insurance for families in India” or “health insurance for pre-existing conditions.”

- Use long-tail keywords such as “simplified insurance advice platform” to capture niche searches.

Why: High intent search behaviour for health insurance terms shows consistent demand year-round.

Content Ideas: SEO-optimized blogs and landing pages for FAQs like “How to choose health insurance in India.”

B. LinkedIn

Method:

- Promote thought leadership through posts that highlight Ditto’s differentiation (e.g., no spam, transparency, family focus)

- Amplify user testimonials to build credibility and trust

- Tailor content towards mid-career professionals and family-oriented ICPs

Why: Users in professional networks (e.g., ICP 2 and ICP 3) frequently engage with recommendations and are likely to trust insurance advisors through LinkedIn.

Content Ideas: Share relatable user stories, “How Neha secured her family with Ditto.” or "Repost UGC testimonial"

C. Finshots

Method:

- Create dedicated segments for insurance advice, integrated into the existing FinShots newsletter.

- Offer exclusive call-to-actions in FinShots content for readers to book advisory calls.

Why: Established FinShots readership trusts its content and is already aware of Ditto.

Content Ideas: “5 Insurance Tips for Every Indian Household.” or FinShots-exclusive user benefits, such as priority advisory slots.

Secondary Platforms

A. YouTube:

Method: Publish explainer videos like “Health Insurance 101” and “How Ditto Makes Insurance Simple.”

Why: Helps capture intent-based searches with visual, engaging content.

Content Ideas:

- “How We Simplify Insurance Advisory in 30 Minutes.”

- Comparison videos: “Policy A vs B – What Makes them Different.”

Content Loop

Name of the Loop | Hook | Generator | Distributor | Action |

|---|---|---|---|---|

Family Protection Score | Your Family deserves the best. See how prepared you are for their future through the Family Protection Score? | Ditto Team builds a scoring system backed by simple and transparent parameters like coverage type, gaps in insurance, and age/life stage of different family members | Users share their scores in family WhatsApp groups, Instagram Stories or LinkedIn | Motivate users to evaluate their insurance needs and book a free consultation with Ditto for personalized advice. |

Insurance IQ Quiz | How well do you really understand your insurance policy? Test your Insurance IQ with this quick quiz! | Ditto creates an engaging, interactive quiz that simplifies complex insurance terms and concepts into relatable scenarios. | Users share their scores & checklist on LinkedIn, Instagram Stories, or WhatsApp groups to showcase their financial knowledge. | Educate users about insurance while driving traffic back to Ditto’s platform for consultation. |

A surprising fact | Did you know? 85% of Indians don’t know this key fact about insurance claims. Do you? | Ditto creates a reel that uncovers a particular policy that shares surprising, thought-provoking stats such as claim rejection rates, policy gaps, or hidden clauses. | Users repost or share the content on Instagram, Twitter, and Facebook, tagging friends or family to raise awareness. | Encourage users to book a free advisory call to identify and fix gaps in their coverage. |

Preferred Content Loop:

Why can this work?

- Alignment with ICP 2 (family-oriented individuals): During the interviews, one of the respondent shared, “I want to know if I’m doing enough for my family’s future. It’s hard to tell if what I have is sufficient or if I’m missing something.” This group often struggles with understanding how well-protected their family is, as highlighted during interviews. The Family Protection Score addresses this uncertainty by offering a clear, actionable metric. Hence improving the probability to create User-Generated awareness through the quiz

- Increasing Social Signalling: A family-oriented user mentioned, “I often share financial milestones or achievements with my family and colleagues. It feels good to be seen as responsible.” The ability to share their Family Protection Score on platforms like LinkedIn and WhatsApp not only allows users to showcase their planning but also encourages others to take the test, creating a natural referral loop.

- Encourages Iterative Engagement: Many users expressed confusion about whether their current insurance policies were adequate. One respondent stated, “I’ve bought insurance, but I’m still not sure if it’s enough.” The Family Protection Score offers iterative value by recommending additional steps to improve their score, such as adding health or life insurance policies.

- Insurance is often perceived as boring and complex. A scoring system makes it tangible and gamified, encouraging users to interact with it out of curiosity or social competitiveness. The gamified aspect and sharability create a natural 1-few or 1-many loop within family and friend groups.

Distribution Plan:

The key-platforms for distribution for users are:

- LinkedIn: Professionals, especially family-oriented individuals, can share their Family Protection Scores in posts with captions like, “My Family Protection Score is 90! Feeling proud and secure thanks to Ditto Insurance. How about yours?”

- Instagram Stories: Using engaging visuals and polls, users can share their scores with captions like, “How protected is your family? Take the test at Ditto!”

- WhatsApp Groups: Easy sharing options encourage users to post their scores in family or friends’ groups, sparking curiosity and peer comparisons.

These align with the current channels that Ditto is pushing for right now.

What's the Life-Time Customer Value for Ditto?

- Average Order Value (AOV):

- Frequency:

- Insurance policies are usually renewed 1.5 years (if multiple policies are purchased).

- Retention:

- Given Ditto’s exceptional customer experience and industry trends, customers are likely to stay for 10 years (as long as claims are smooth and policies remain competitive).

LTV = AOV * Frequency * Retention

LTV = 2250 * 1.5 * 10 = ₹33,750

To maintain a healthy CAC:LTV ratio of 1:3 - Ditto can spend up to ₹11,250 to spend on paid ads to acquire one customer.

Choosing an ICP:

I want to choose ICP 2 - Family Oriented Individuals as my ICP for running paid ads. Family-oriented individuals are highly motivated to secure their loved ones’ futures, making them an ideal target for insurance products. Their life stages—such as planning for marriage, having children, or caring for aging parents naturally align with the need for comprehensive insurance coverage. This segment values trust, simplicity, and transparency, which perfectly matches Ditto’s no-spam, customer-first approach. This will allow us to secure the future customers today.

Channels:

LinkedIn and Google Search complement each other to effectively target Ditto’s ICP of family-oriented individuals.

• LinkedIn offers precise targeting based on professional attributes like job title, income, and location, making it perfect to engage working professionals who are more likely to invest in insurance. Its professional tone and focus on financial security align seamlessly with Ditto’s customer-first approach, building trust and credibility.

• Google Search captures high-intent users actively looking for insurance solutions. By targeting keywords like “best family health insurance” or “how to choose life insurance,” Ditto can reach users at critical decision-making stages. This ensures Ditto stays visible at the moment users are most likely to convert.

Core Marketing Pitch:

Insurance isn’t about policies, it’s about peace of mind. At Ditto, we don’t sell plans—we secure your loved ones with advice tailored to you. No jargon. No pressure. Just clarity and care. Let’s redefine what insurance feels like—book your free call now.

Ad1:

Ad2:

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.